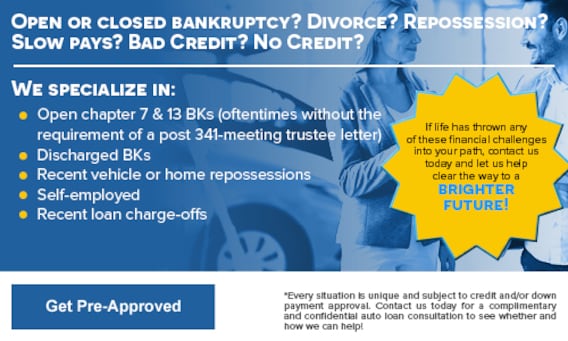

Getting an open bankruptcy auto loan is difficult but not insurmountable and if you have filed a chapter 13 bankruptcy it can be easier to get approved.

Open chapter 13 auto financing.

The dealer will draw up a buyer s order with the details of the loan for the borrower to take.

How to receive bankruptcy open chapter 13 auto loans.

If you need an auto loan you may be wondering about where to find car dealers that deal.

7 wipes your debt a way instantly it leaves a shadow on your report for 10 years.

After finding a dealer and lender willing to work with someone in bankruptcy you ll need to follow these four steps in order to get approved for a car loan with an open chapter 13.

It is actually fairly common for a car to be purchased during this time period.

These steps ensure that you don t take on more debt than you can handle once again putting your finances at risk.

If you re ready to find financing but aren t sure where to turn let auto credit express lead the way.

The first step is to get a sample financing statement from the dealer to take to your bankruptcy trustee.

No matter if you file a chapter 7 or a chapter 13 dealing with a bankruptcy isn t easy.

Get a buyer s order from a dealership.

In case you re not familar there are two major differences between a ch 7 and ch 13 bankruptcy.

Chapter 13 open bankruptcy auto loans an open bankruptcy is the time period from when you first submit your application until you receive the discharge paper from the judge.

You shouldn t let this scare you though.

It can be difficult finding a dealer willing to work with someone in a chapter 13 bankruptcy.

The process of financing a car during a chapter 13 bankruptcy.

You can still get a car even if you re finishing up a bankruptcy proceeding.

4 steps to getting a car loan in chapter 13.

For this reason the bankruptcy courts and trustees have made it fairly simple to buy a car after filing for chapter 13 bankruptcy.

The first step is finding a dealership that s signed up subprime lenders who are willing to finance an open bankruptcy loan.

The first is that while a ch.

To get the court s permission a specific series of steps must be followed.

But that s not the truth.

Purchasing a car after filing for chapter 13 bankruptcy is sometimes necessary.

Financing a car while in chapter 13 bankruptcy many people think that once they go into bankruptcy their ability to buy pretty much anything on credit is gone.

An auto loan will only be considered after the chapter 7 bankruptcy is complete and you have your 341 papers.