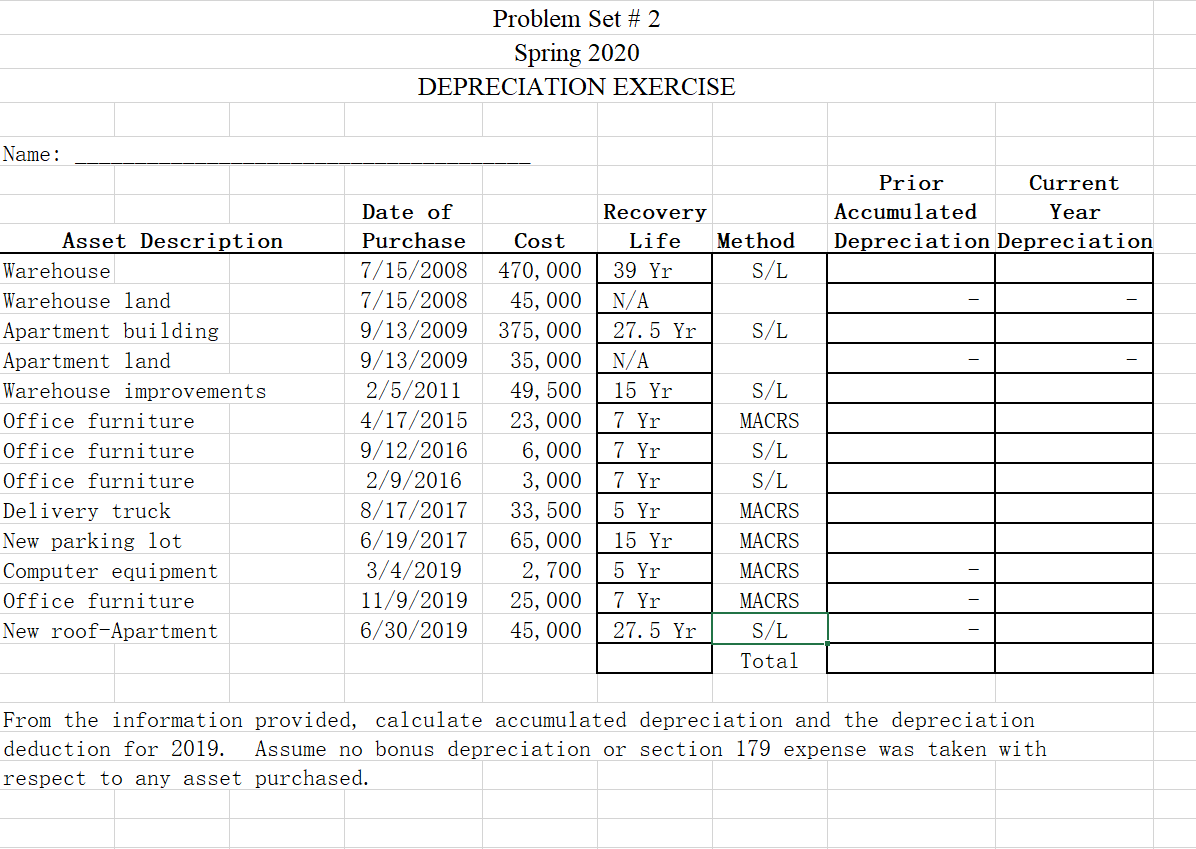

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

Roof depreciation life.

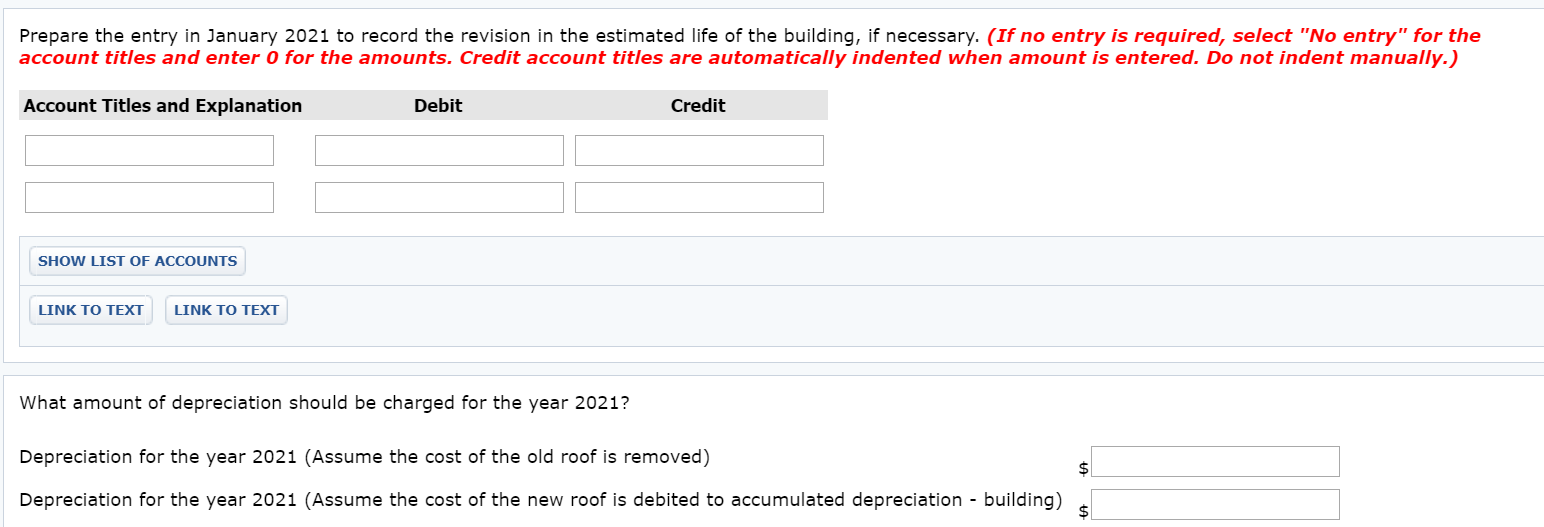

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged.

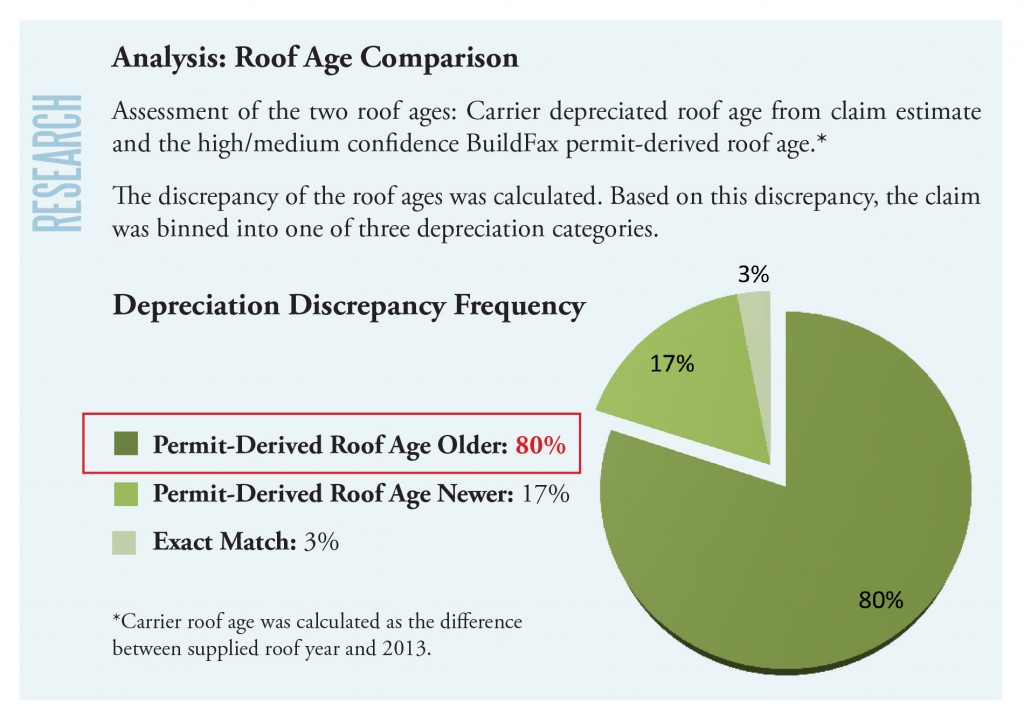

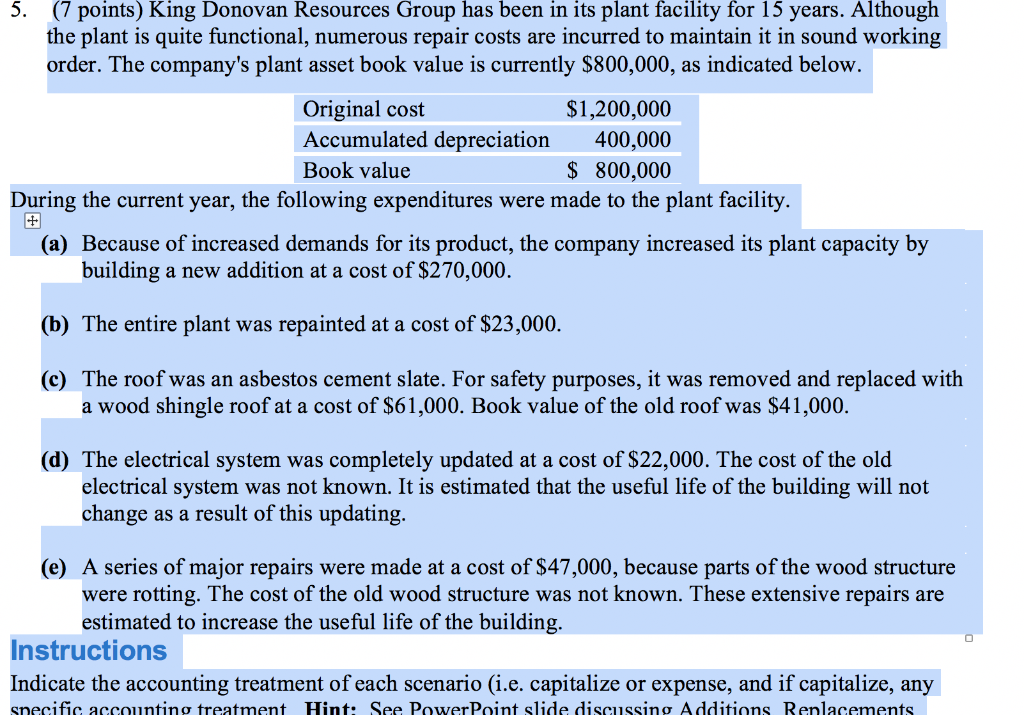

The most common and often significant item that is evaluated is roofing related work.

10 000 for the first year 16 000 for the second year.

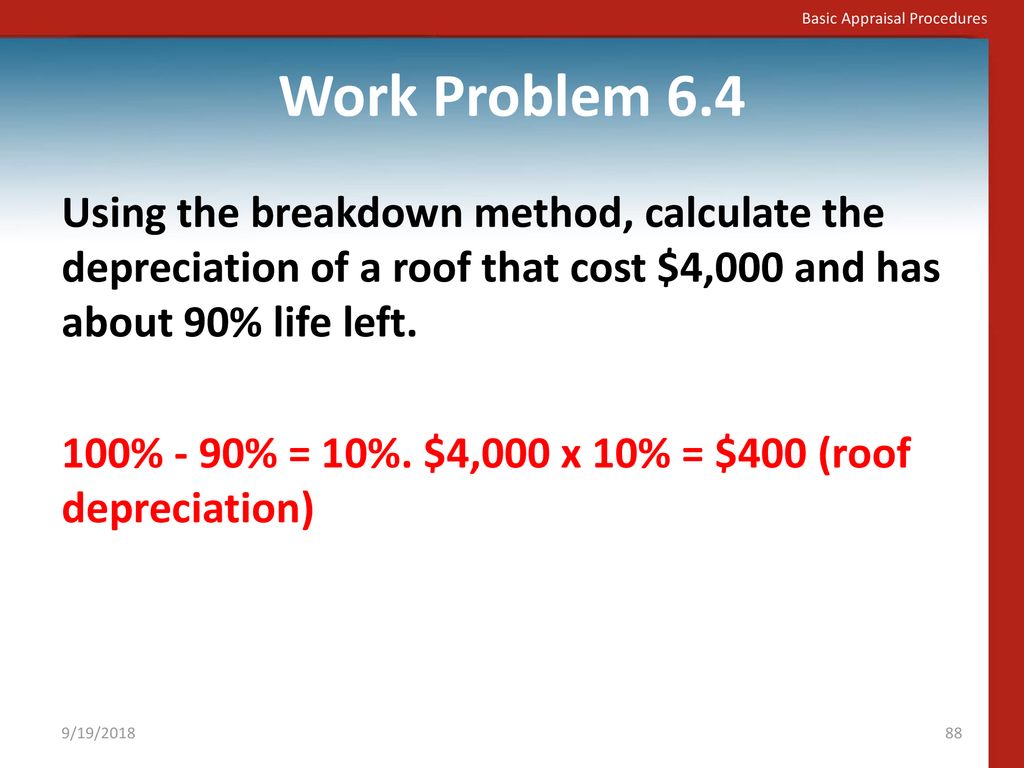

How is depreciation on a roof calculated.

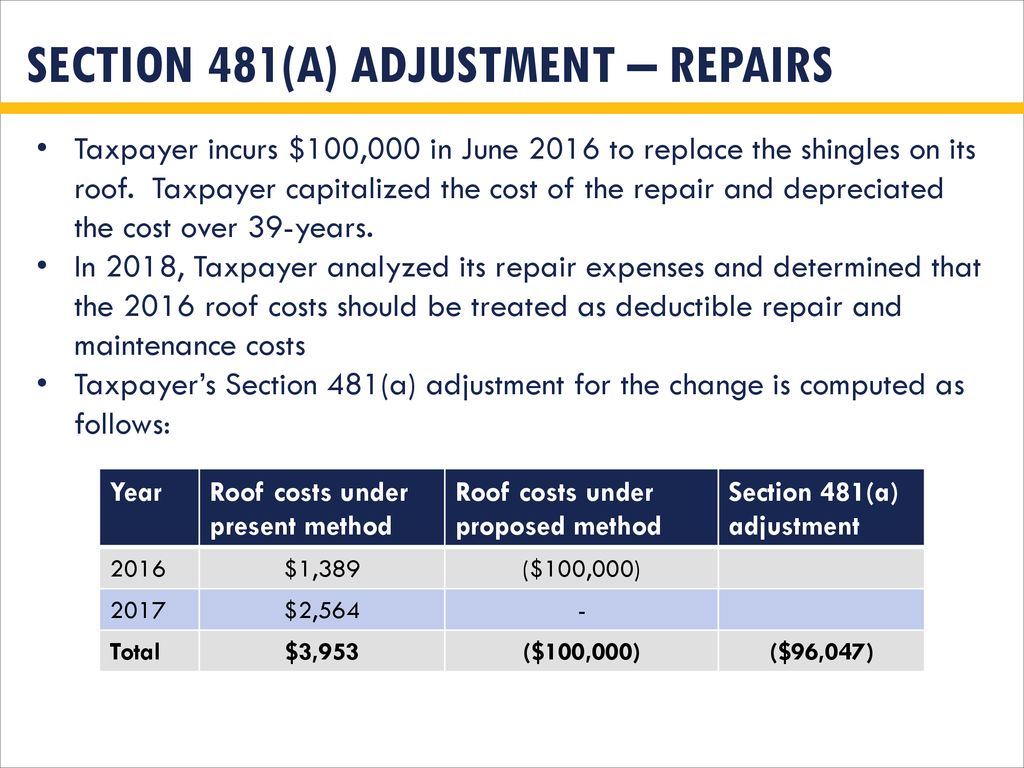

For example going from asphalt shingles 20 year life to clay tile 50 year life is a betterment that requires capitalization.

How to depreciate a new roof on rental property.

When a claims adjuster looks at a roof he will consider the condition of the roof as well as its age.

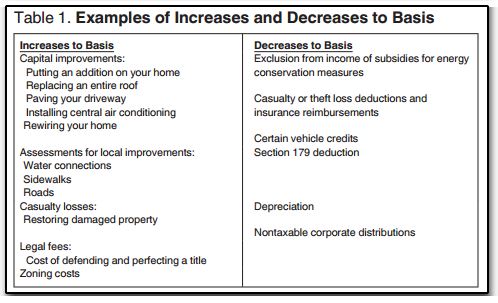

A capital improvement is any major replacement or renovation that betters the rental property or.

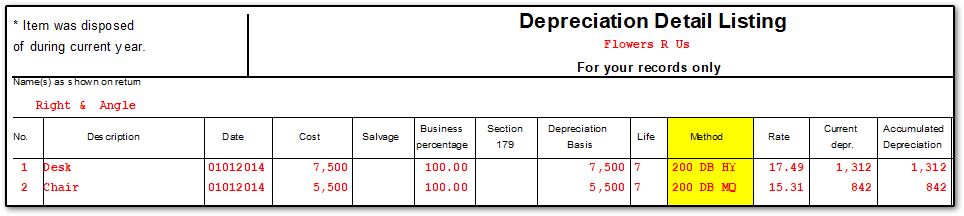

If the taxpayer doesn t claim bonus depreciation the greatest allowable depreciation deduction is.

For example if the new roof costs 15 000 divide that figure by 27 5.

Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

In many cases only a portion of the roofing system is replaced and depending on the facts those costs may be deducted as repairs.

Figure out the beginning and end dates.

Changes to depreciation limitations on luxury automobiles and personal use property.

This means the roof depreciates 545 46 every year.

Decide if the new roof is a capital improvement.

Repainting the exterior of your residential rental property.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Calculating depreciation based on age is straightforward.

The new law changed depreciation limits for passenger vehicles placed in service after dec.

If improved materials were used taxpayers would need to focus on the expected life of the old roof versus the expected life of the new roof.