Life expectancy of building components will vary depending on a range of environmental conditions quality of materials quality of installation design use and maintenance.

Roof depreciation rate ato.

For some types of transport and agricultural machinery and gas.

You must also file form 4562 in the year you first place the roof in service.

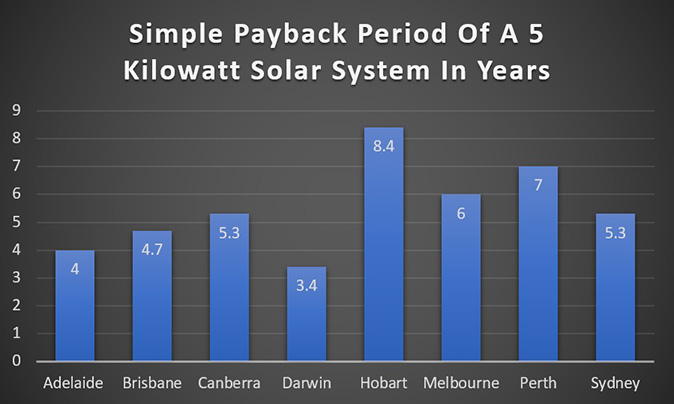

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged.

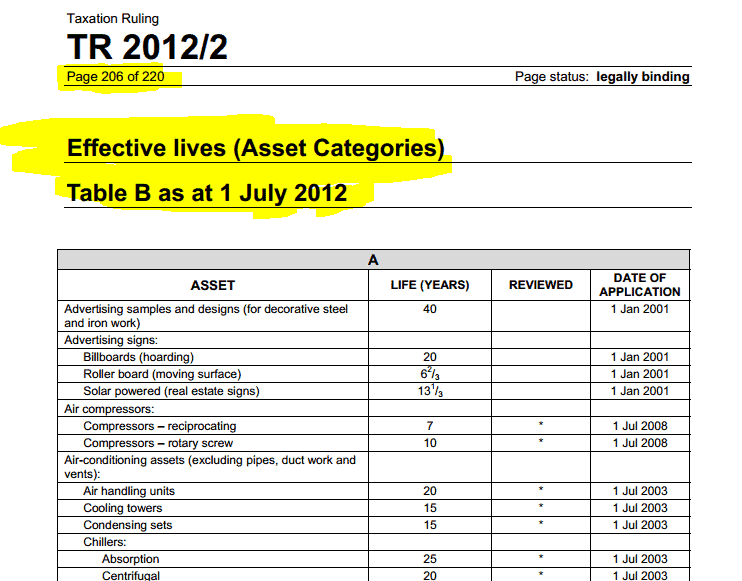

For most depreciating assets you can use the ato s determinations of effective life published in taxation rulings updated annually.

The roof depreciates in value 5 for every year or 25 in this case.

Individual taxpayers report income and expenses for rental properties on schedule e of form 1040.

The 2nd question is if we can cliam it as an outright deduction if it is a repair and maintenance or will it be part of the building.

You must also take into account the month the roof is installed for the first year.

The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.

Calculating depreciation based on age is straightforward.

To secure a 20 year loan of 209 000 to purchase a rental property for 170 000 and a private motor vehicle for 39 000 the hitchman s paid a total of 1 670 in establishment fees valuation fees and stamp duty on the loan.

Divide the yearly depreciation of 545 46 by 4 5.

An item that is still in use and functional for its intended purpose should not be depreciated beyond 90.

When a claims adjuster looks at a roof he will consider the condition of the roof as well as its age.

For example if you install a new roof in august you can claim four and a half months of depreciation for the first year.

Join australia s most dynamic and respected property investment community.

Roof replacement would it be an improvement or eligible for depreciation discussion in accounting tax started by firsttimebuyer 1st feb 2016.

You can claim 121 24 for that first year.

The effective life is used to work out the asset s decline in value or depreciation for which an income tax deduction can be claimed.

Ato depreciation rates 2020 table a.

Name effective life diminishing value rate prime cost rate date of application.

Electricity gas water and waste services 26110 to 29220.

To all the accountants here we are getting our roofs repaired and repainted and was wondering if this is a repair and maintenance or improvement.

Apportionment of borrowing expenses.

.png)